Understanding property taxes in Summit County, Ohio can feel confusing, especially for homeowners, buyers, and investors who are new to the area. Tax rates vary by community and school district, which means two homes with the same value can have very different tax bills.

To simplify this process, our Summit County Ohio Property Tax Calculator helps you estimate your annual property taxes quickly and accurately using publicly available tax rate percentages. This calculator uses publicly available tax rate percentages and does not access official county billing systems.

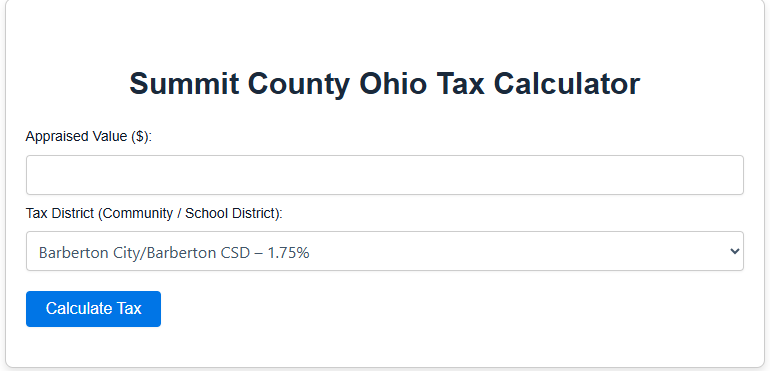

Use the calculator below to estimate your annual Summit County property tax based on your home’s value and tax district.

Summit County Tax Calculator

How Property Taxes Work in Summit County, Ohio

Property taxes in Summit County are primarily based on the market value of your home and the effective tax rate applied in your specific community and school district. Unlike some counties that require complex millage calculations, Summit County often publishes effective tax rates as percentages, making it easier for homeowners to estimate taxes. Actual tax calculations may still involve millage rates and adjustments at the county level.

For example:

Bath Township / Revere LSD

$100,000 × 1.80% = $1,800 per year

This percentage already reflects local levies, school district funding, and other approved taxes.

Why School Districts Matter So Much

One of the biggest factors influencing property taxes in Summit County is the school district. School levies fund education, facilities, and community services, and these levies differ widely across districts.

For instance:

- Barberton City / Barberton CSD has a different rate than

- Cuyahoga Falls City / Cuyahoga Falls City School District

Even neighboring communities may have noticeably different tax percentages. This is why choosing the correct community/school district combination is essential when estimating property taxes.

What Is the Summit County Ohio Property Tax Tool?

The Summit County Ohio Property Tax Tool is a simple online tool designed to help users estimate their annual property tax based on:

- Appraised (market) value of the property

- Selected community and school district

- Published effective tax rate for that district

Instead of manually doing math or searching through tax tables, the calculator instantly shows an estimated yearly tax amount. The calculator is intended for planning and comparison purposes only.

How to Use the Summit County Tax Calculator

Using the calculator is straightforward and beginner-friendly.

Step 1: Enter the Appraised Value

Input the estimated or known market value of the property. This can be the purchase price, county appraisal, or listing value.

Step 2: Select Your Community / School District

Choose the correct community and school district from the dropdown list, such as:

- Bath Township / Revere LSD

- Barberton City / Barberton CSD

- Cuyahoga Falls City / CFSD

Step 3: Calculate

Click the Calculate Tax button to instantly see your estimated annual property tax.

The calculation follows this basic formula:

Annual Property Tax = Appraised Value × Tax Rate (%)

Example Property Tax Calculations

Here are a few examples to help you understand how tax rates affect your bill:

Example 1: Bath Township / Revere LSD

- Home Value: $100,000

- Tax Rate: 1.80%

- Estimated Annual Tax: $1,800

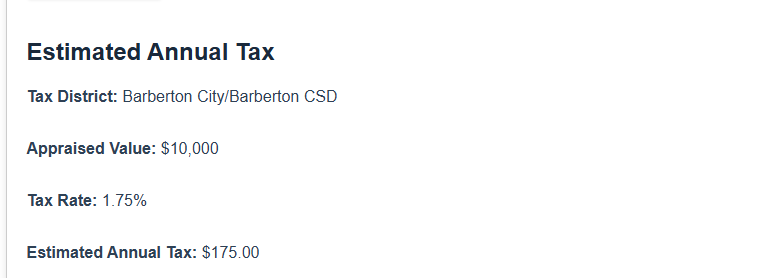

Example 2: Barberton City / Barberton CSD

- Home Value: $150,000

- Tax Rate: 1.75%

- Estimated Annual Tax: $2,625

Example 3: Cuyahoga Falls City / CFSD

- Home Value: $200,000

- Tax Rate: 1.87%

- Estimated Annual Tax: $3,740

These examples show why knowing your exact district matters when planning finances.

Who Should Use This Calculator?

The Summit County Ohio Property Tax Calculator is helpful for many types of users:

Homebuyers

Estimate taxes before purchasing a home to avoid budget surprises after closing.

Homeowners

Plan yearly expenses and understand changes if your home value increases.

Real Estate Investors

Quickly compare tax burdens across different communities and districts.

Real Estate Agents

Provide clients with fast, clear tax estimates during property discussions.

What This Calculator Does Not Include

While the calculator provides a strong estimate, it does not account for every possible factor, including:

- Homestead exemptions

- Owner-occupancy credits

- Special assessments

- Newly approved or expiring levies

Actual tax bills may be slightly higher or lower depending on individual circumstances. The calculator should be used as an estimate, not an official tax statement. Official tax bills are issued by the Summit County Fiscal Office and may differ from estimates shown here.

Why Tax Rates Change Over Time

Property tax rates in Summit County can change due to:

- New school or community levies

- Expiring levies

- Changes in property valuations

- Voter-approved tax measures

Because of this, it’s important to check updated rates each year or use tools that reflect the most recent publicly available data.

Benefits of Using an Online Property Tax Calculator

Using an online calculator offers several advantages:

- Saves time compared to manual calculations

- Reduces confusion around tax percentages

- Helps with financial planning and budgeting

- Improves transparency for buyers and sellers

Instead of guessing, you get a clear, data-based estimate within seconds.

Important Disclaimer

This Summit County Tax Calculator is provided for informational and educational purposes only. It is not affiliated with the Summit County Fiscal Office or any government agency. For official tax amounts, exemptions or billing questions, always consult the Summit County Fiscal Office or your local taxing authority. This website does not collect payments or process tax filings.

Final Thoughts

Property taxes are a major part of homeownership in Summit County, Ohio. Because tax rates vary significantly by community and school district, having the right information makes a big difference.

The Summit County Ohio Property Tax Calculator gives you a simple estimation tool to estimate your annual taxes and make informed financial decisions.

Whether you’re buying your first home, investing in real estate, or simply planning your yearly budget, this calculator helps you understand what to expect without complicated tax tables or confusing formulas.

Frequently Asked Questions

1. How accurate is the Summit County Ohio Property Tax Calculator?

The calculator provides an estimated annual property tax based on publicly available effective tax rates for Summit County communities and school districts. While it offers a close estimate, the final tax amount may vary due to exemptions, credits, or newly approved levies.

2. Does this calculator use official Summit County tax bills?

No. This tool does not access official tax bills or county databases. It uses general tax rate percentages to help users estimate taxes for budgeting and planning purposes only.

3. Why do property tax rates differ by school district in Summit County?

School districts play a major role in property taxation. Each district may have different levies approved by voters, which directly affect the tax rate. That’s why two homes with the same value can have different tax amounts in different districts.

4. Can I use this calculator before buying a home?

Yes. This calculator is especially helpful for homebuyers who want to estimate yearly property taxes before making a purchase decision. It helps you understand ongoing costs beyond the purchase price.

5. Does the calculator include homestead or owner-occupancy exemptions?

No. The calculator does not apply homestead exemptions, owner-occupancy credits, or other special reductions. These exemptions can lower your actual tax bill and vary by individual eligibility.