Transferring property ownership in Summit County, Ohio involves more than signing paperwork. Whether you are selling a home, gifting property to a family member, or transferring real estate through inheritance, Ohio law requires specific steps to make the transfer legally valid.

This guide explains how to transfer property ownership in Summit County, including deed types, conveyance fees, recording requirements, and how the Summit County Auditor and Recorder update official property and tax records in 2026.

What Does Property Ownership Transfer Mean?

Property ownership transfer occurs when the legal title of real estate moves from one person or entity to another. This process is formalized by recording a deed with the Summit County Auditor’s Office, making it part of the public record.

Common Reasons for Property Ownership Transfer

- Sale of property

- Gifting property to a family member

- Inheritance through a will or trust

- Transfer to a trust or LLC

- Divorce settlements

Types of Property Transfer in Summit County

- Sale (Purchase and Sale Agreement)

The most common method, where the property is sold to a buyer for agreed consideration. - Gift Deed

Ownership is transferred voluntarily without payment. Often used for family transfers. - Inheritance (Probate or Trust Transfer)

Property may pass to heirs through probate court or a living trust. - Quitclaim Deed

Transfers any interest the grantor has in the property without warranties. Common in divorce or intra-family transfers. - Special Purpose Transfers

Such as corporate transfers, foreclosure sales, or tax lien transfers.

Steps to Transfer Property Ownership in Summit County

1. Prepare the Deed

The deed is the legal document that transfers ownership. Common types of deeds in Summit County include:

- Warranty Deed: Guarantees that the grantor holds clear title.

- Quitclaim Deed: Transfers interest without guaranteeing title.

- Executor’s Deed: Used in probate transfers.

Key Information on a Deed:

- Full names of the grantor (current owner) and grantee (new owner)

- Legal description of the property

- Signatures of parties involved

- Notary acknowledgment

2. Verify Property Information

Before recording:

- Confirm the legal description matches the property record

- Check for existing liens, mortgages, or easements

- Ensure correct spelling of names and addresses

3. Calculate and Pay Conveyance Fees

In Summit County, a real estate conveyance fee is required when transferring property.

- Rate: $4 per $1,000 of the property sale price

- Paid at the Summit County Auditor’s Office when recording the deed

- State tax: $1 per $1,000

- County tax: $3 per $1,000

Example:

- Sale price: $150,000

- Fee: 150 x $4 = $600

Fee amounts may vary depending on exemptions or special circumstances.

4. Record the Deed at the Summit County Recorder

The deed must be filed with the Summit County Recorder’s Office to legally transfer ownership.

Requirements for recording:

- Signed and notarized deed

- Payment of recording fees and conveyance taxes

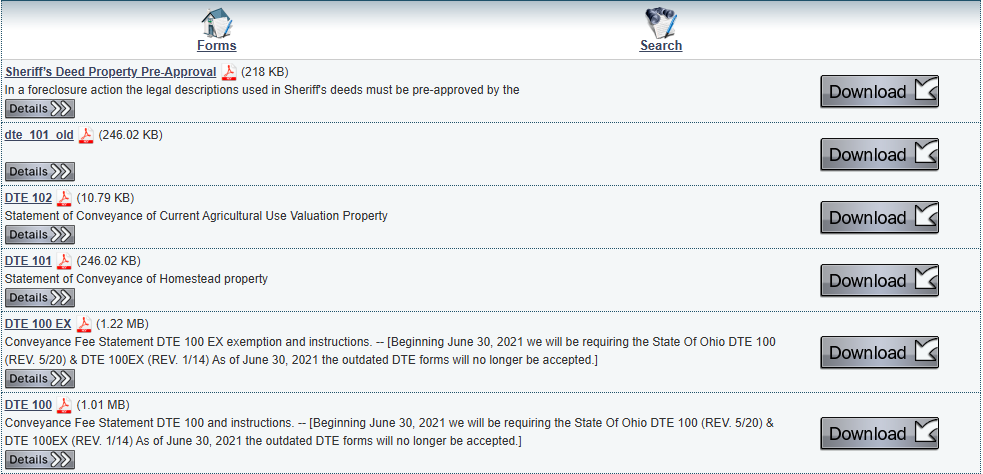

- Any additional forms required by the Summit County Auditor or Recorder

Once recorded, the auditor updates the property records, and the new owner is officially recognized.

5. Update Property Tax Records

After the transfer:

- Notify the Summit County Auditor to update property tax records

- Ensure property tax bills are sent to the new owner

- Check if any exemptions or special assessments apply

Tips for a Smooth Property Transfer

- Hire a Real Estate Attorney – Especially for complex transfers, probate, or commercial property.

- Title Search – Confirm that the grantor has clear title before completing the transfer.

- Consider a Title Insurance Policy – Protects the new owner from undiscovered claims or liens.

- Check Local Requirements – Summit County may have specific forms or procedures depending on the municipality.

- Keep Copies of All Documents – Maintain a record of the deed, tax payments, and receipts for future reference.

Common Challenges in Property Ownership Transfers

- Outstanding liens or mortgages

- Disputes among heirs in inheritance cases

- Incorrect legal description on the deed

- Unpaid property taxes

- Clerical errors at the Recorder or Auditor offices

Being aware of these issues and addressing them before recording can prevent delays and legal complications.

Conclusion

Transferring property ownership in Summit County, Ohio requires proper deed preparation, payment of conveyance fees, recording with the county, and updating tax records. Each step plays a critical role in protecting ownership rights and ensuring compliance with Ohio law.

By understanding the process and working with the appropriate county offices, property owners can complete transfers smoothly and avoid legal or tax complications.

Frequently Asked Questions

Do I need an attorney to transfer property in Summit County?

No, an attorney is not legally required, but hiring one is strongly recommended for probate, inheritance, or complex property transfers.

What fees are involved in transferring property ownership?

Fees typically include conveyance taxes ($4 per $1,000), recording fees, and optional attorney or title insurance costs.

How long does it take to record a deed in Summit County?

Deed recording usually takes a few business days once all documents and fees are submitted.

Can I transfer property to a family member as a gift?

Yes, property can be transferred using a gift deed, though gift tax reporting may apply in some cases.

How is inherited property transferred in Summit County?

Inherited property may require probate court approval or trust documentation before recording the deed.