The Summit County conveyance fee is $4 per $1,000 of a property’s property value. Sellers usually pay it at the Summit County Auditor’s Office before the deed is recorded. Use this calculator to quickly estimate your fee.

Note: In some transactions, buyers may agree to pay the fee as part of closing. Always confirm responsibility in your purchase agreement.

Buying or selling property in Summit County, Ohio? One cost many people overlook is the real estate property transfer fee. Required by Ohio law, this fee must be paid before a property deed can be officially recorded. Understanding how the Summit County conveyance fee works helps buyers, sellers, and investors accurately estimate closing costs and avoid last-minute surprises.

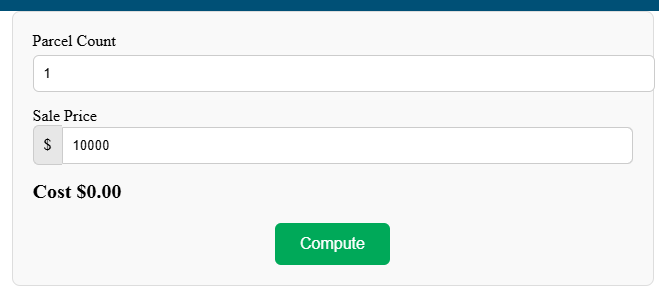

Summit County, Ohio Conveyance Fee Calculator

Cost $0.00

What Is a Conveyance Fee in Summit County, Ohio?

A conveyance fee is a transfer tax charged when ownership of real property changes hands. In Ohio, this fee applies to most property transfers, including residential homes, commercial buildings, vacant land, and multi-parcel sales.

In Summit County, the conveyance fee is collected at the time the deed is recorded with the Summit County Auditor. Without paying this fee, the deed cannot be legally recorded, meaning the transfer of ownership is not officially recognized. Always verify your fee with the Summit County Auditor to ensure accuracy.”

Summit County Ohio Conveyance Fee Rate

Summit County follows Ohio’s standard conveyance fee structure:

- State of Ohio fee: $1 per $1,000 of the property’s sale price (1 mill)

- Summit County fee: $3 per $1,000 of the property’s sale price (3 mills)

Total Conveyance Fee Rate

$4 per $1,000 of value

This combined transfer tax rate applies to nearly all taxable property transfers in Summit County. This rate applies to most taxable property transfers in Summit County, but some exemptions exist

How the Summit County Conveyance Fee Is Calculated

The calculation is straightforward but includes an important rounding rule.

Step 1: Round the Sale Price

Ohio law requires that the property value be rounded up to the nearest $100 before calculating the fee

Step 2: Apply the Conveyance Rate

After rounding, the total value is divided by 1,000 and multiplied by $4.

Example Calculation

Sale Price: $100,500

Rounded Value: $100,500 (already rounded to the nearest $100)

Calculation:

100.5 × $4 = $402 conveyance fee

Another Example

Sale Price: $100,401

Rounded Value: $100,500

Calculation:

100.5 × $4 = $402

This rounding rule can slightly increase the final fee, so it’s important to account for it when estimating closing costs.

Parcel Transfer Fees in Summit County

In addition to the conveyance fee, Summit County may charge a parcel transfer fee, commonly calculated per parcel included in the transaction.

- Typical parcel fee: $0.50 per parcel

If a property sale includes multiple parcels, this small fee is added to the total conveyance cost. This is why many online calculators ask for parcel count along with the sale price. Check the Summit County Auditor’s website for current parcel fees

Who Pays the Conveyance Fee in Summit County?

In most Summit County real estate transactions:

- The seller pays the conveyance fee

However, payment responsibility can be negotiated in the purchase agreement. Some buyers may agree to cover this fee as part of closing terms, especially in competitive markets or commercial deals.

Always review your purchase contract to confirm who is responsible. Fee responsibility can vary; always confirm in your purchase agreement.

Where Is the Conveyance Fee Paid?

The Summit County conveyance fee is paid at the:

Summit County Auditor’s Office

The fee must be paid before or at the time the deed is recorded with the Summit County Fiscal Office / Recorder. If the fee is not paid, the deed will be rejected.

Most closings handle this automatically through the title company, but understanding the fee is still important for transparency.

Are Any Transfers Exempt from the Conveyance Fee?

Yes. Ohio law provides exemptions for certain types of property transfers, including:

- Transfers between spouses

- Transfers to or from government entities

- Transfers resulting from inheritance or court orders

- Transfers correcting prior deeds (no change in ownership)

- Transfers with no actual consideration (in specific cases)

Even when exempt, documentation must usually be filed with the Auditor explaining the reason for exemption.

Why Summit County Charges a Conveyance Fee

The conveyance fee serves several purposes:

- Supports county and state operations

- Helps fund local government services

- Assists in maintaining property records and assessments

- Ensures accurate tracking of property ownership changes

Because it’s tied to property value, the fee scales fairly across different transaction sizes.

Using a Summit County Conveyance Fee Calculator

An online Summit County conveyance fee calculator is the easiest way to estimate your cost. A good calculator should:

- Apply the $4 per $1,000 rate

- Automatically round the sale price to the nearest $100

- Allow entry of parcel count

- Display the total estimated cost instantly

Using a calculator helps sellers plan closing expenses and avoids surprises at the Auditor’s office.

Common Mistakes to Avoid

Many people make small errors when estimating conveyance fees, such as:

- Forgetting the rounding rule

- Using the wrong county rate

- Ignoring parcel transfer fees

- Assuming the buyer always pays

- Confusing conveyance fees with property taxes

Understanding these details ensures a smoother closing process. Small errors in estimation can delay deed recording; review each step carefully

Conveyance Fee vs Property Taxes in Summit County

The conveyance fee is separate from property taxes. Unlike taxes, it is paid once at transfer and is based on sale price, not assessed value.

Final Thoughts

The Summit County Ohio conveyance fee is a required part of most real estate transactions, calculated at $4 per $1,000 of value, with the sale price rounded up to the nearest $100. While it’s not the largest closing cost, it is mandatory and must be paid before a deed can be recorded.

Whether you’re a homeowner selling a property, a buyer reviewing closing costs, or an investor handling multiple parcels, knowing how this transfer cost works and using a reliable calculator can save time and prevent delays.If you’re planning a property transfer in Summit County, estimating your conveyance fee early is one of the smartest steps you can take.

Frequently Asked Questions (FAQs)

1. What is the conveyance fee in Summit County, Ohio?

The conveyance fee in Summit County is $4 per $1,000 of a property’s sale price. This total includes a $1 state fee and a $3 Summit County fee, and it applies to most real estate transfers.

2. How is the Summit County conveyance fee calculated?

The total sale price is rounded up to the nearest $100, then divided by 1,000 and multiplied by $4. For example, a $250,300 sale is rounded to $250,300 and results in a conveyance fee of $1,001.20.

3. Who pays the conveyance fee in Summit County?

In most cases, the seller pays the conveyance fee, but this can be negotiated in the purchase agreement. Always check the contract to confirm who is responsible for payment.

4. Are there any exemptions from the conveyance fee in Summit County?

Yes. Certain transfers may be exempt, such as transfers between spouses, inheritances, court-ordered transfers, or government transactions. Supporting documentation must be provided to the Summit County Auditor for exemption approval.

5. Where do I pay the conveyance fee in Summit County?

The fee is paid at the Summit County Auditor’s Office when the deed is submitted for recording. The deed cannot be recorded until the conveyance fee is fully paid.