Quick Answer

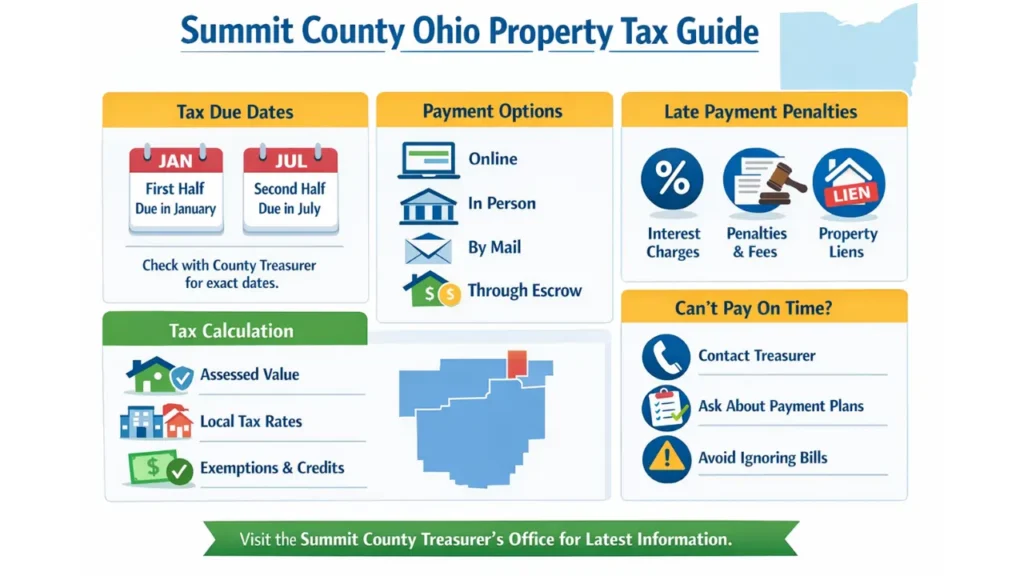

Summit County, Ohio property taxes are typically due in two installments each year one in January and one in July. Late payments may result in interest, penalties, and possible liens. Always confirm exact due dates with the Summit County Treasurer.

Paying property taxes on time is a key responsibility for homeowners, landlords, and buyers in Summit County, Ohio. This guide explains Summit County property tax due dates, payment options, and penalties, so you know exactly what to expect and how to stay compliant in 2026.

Whether you live in Akron, own rental property, or recently purchased a home, understanding how the county tax system works can help you avoid unnecessary fees, interest charges, and legal complications.

Overview of Summit County Property Taxes

Property taxes in Summit County are administered and collected by the Summit County Treasurer. Revenue from these taxes supports essential local services, including public schools, road maintenance, emergency services, and local government operations.

Your tax bill is based on property value information maintained by the Summit County Auditor and tax rates set by local taxing authorities.

How Property Taxes Are Calculated

Assessed Property Value

The Summit County Auditor determines a property’s assessed value based on periodic reappraisals and updates. This value represents a portion of the property’s estimated market value.

Local Tax Rates

Tax rates vary depending on:

- School district

- City or village

- Township

- Voter-approved levies

This is why two similar homes in different areas may have different tax bills.

Exemptions and Tax Credits

Some property owners may qualify for:

- Homestead exemptions

- Senior citizen reductions

- Disabled veteran benefits

Eligibility and application requirements are managed by the Auditor’s office.

Note: Always verify eligibility before assuming a reduction applies.

Property Tax Payment Due Dates

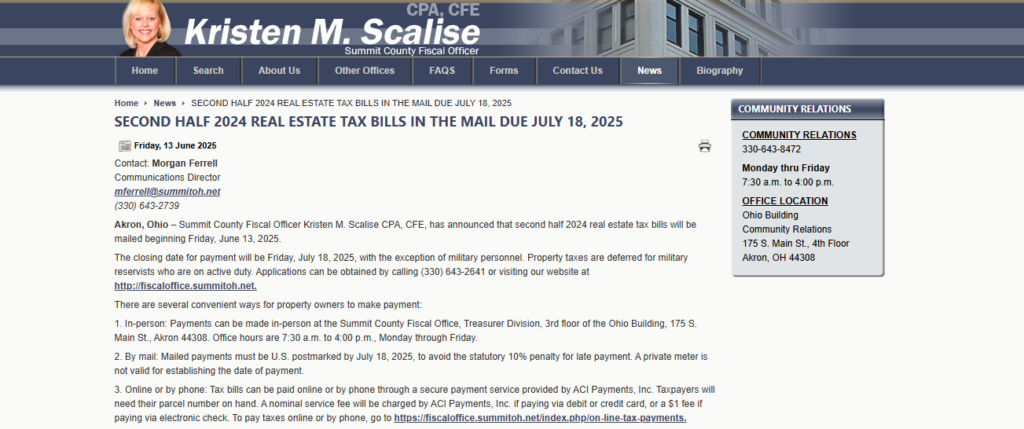

Summit County property taxes are usually divided into two installments:

First Half Payment

- Typically due in January

- Covers the first portion of the year’s property taxes

Second Half Payment

- Typically due in July

- Covers the remaining portion of the annual tax bill

⚠ Important: Due dates may change slightly each year. Always confirm on the official Treasurer’s site.

How to Pay Summit County Property Taxes

Online Payments

- Pay through the county’s official online payment system

- Fastest way to avoid late posting

In-Person Payments

- Available at the Summit County Treasurer’s Office during business hours

Mail Payments

- Send checks or money orders with your parcel number

- Mail early to avoid delays

Mortgage Escrow Payments

- Many homeowners pay through their lender

- Always verify payment was submitted on time

Tip: Keep confirmation numbers or receipts for your records.

Penalties for Late Payment

Paying property taxes late can lead to:

- Interest Charges: Accrued monthly until payment is received

- Penalties: Additional fees based on how late the payment is

- Lien on Property: The county may place a lien on the property for unpaid taxes

- Tax Sale: Continued non-payment can result in property being sold at a tax auction

How Penalties Accumulate

- 1st Month Late: Small interest and fee

- 2–6 Months Late: Increasing interest and additional penalty

- Beyond 6 Months: Property lien or potential tax sale

Staying ahead of deadlines helps avoid these financial consequences.

Tips for Timely Property Tax Payments

- Mark your calendar with due dates

- Pay online for faster processing

- Set reminders for first and second installment deadlines

- Check for any exemptions or credits you may qualify for

- Keep payment confirmations for your records

What to Do If You Cannot Pay On Time

If you cannot pay your property taxes by the due date:

- Contact the Summit County Treasurer’s office immediately

- Ask about payment plans or deferment options

- Avoid ignoring the bill to prevent penalties and liens

Why Paying on Time Matters

- Prevents extra fees and interest

- Avoids legal actions like liens or tax sales

- Maintains good financial and credit standing

- Supports local community services funded by property taxes

Conclusion

Paying property taxes on time in Summit County, Ohio is essential to avoid penalties, interest, and legal complications. Understanding due dates, installment schedules, payment methods, and penalties ensures homeowners and investors remain compliant and financially secure. Always check with the Summit County Treasurer for the most accurate and updated tax information.

FAQ’s

When are Summit County property taxes due?

Summit County property taxes are generally due in two installments January and July. Exact deadlines vary by year.

What happens if I pay my property taxes late?

Late payments may result in interest charges, penalties, and possible liens if taxes remain unpaid.

Can I pay Summit County property taxes online?

Yes. The county provides an official online payment option through the Treasurer’s office.

Are property tax exemptions available in Summit County?

Some homeowners, including seniors and veterans, may qualify for exemptions or credits through the Auditor.

What if I cannot pay the full amount by the deadline?

Contact the Summit County Treasurer as soon as possible to discuss available options.