Quick Answer

Eligible Summit County homeowners may reduce their property taxes through exemptions such as the homestead exemption, disabled veteran benefits, or agricultural programs. Applications are handled by the Summit County Auditor and must be submitted before annual deadlines.

Property taxes can be a major expense for homeowners in Summit County, Ohio, especially for seniors, veterans, and residents on fixed incomes. This guide explains how to apply for a property tax reduction or exemption in Summit County, who qualifies, and what documents are required in 2026.

If you own and live in your home or own qualifying agricultural or special-use property these programs may legally reduce your tax burden while keeping your property records accurate and compliant.

What Is a Property Tax Reduction or Exemption?

A property tax reduction or exemption lowers the taxable value of a property or removes part of it from taxation altogether. These programs are authorized under Ohio law and administered locally by the Summit County Auditor.

They are designed to:

- Provide tax relief to eligible homeowners

- Support seniors, disabled residents, and veterans

- Encourage approved land uses such as farming or conservation

- Promote fair and consistent property taxation

Note: Reductions do not eliminate property taxes entirely and must be renewed or verified as required.

Who Qualifies for Property Tax Reductions or Exemptions in Summit County?

Common eligibility categories include:

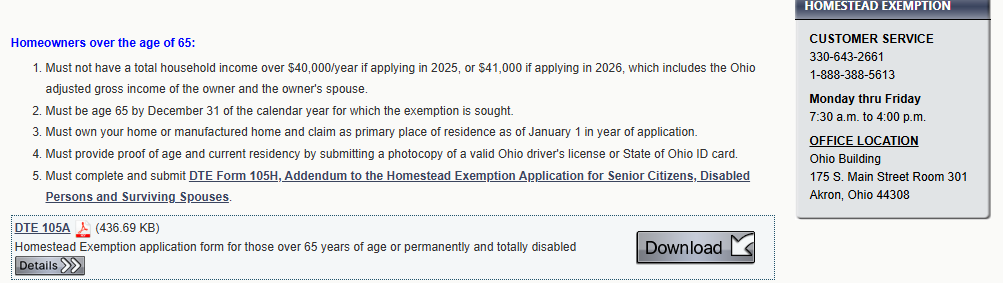

Senior Citizens

Homeowners age 65 or older who occupy the property as their primary residence may qualify for the Ohio homestead exemption, subject to income limits.

Disabled Individuals

Residents with qualifying permanent disabilities may be eligible for property tax relief, depending on program requirements and documentation.

Veterans and Surviving Spouses

Some honorably discharged veterans with service-connected disabilities, as well as eligible surviving spouses, may qualify for exemptions under Ohio law.

Agricultural or Special Use Properties

Land used for farming, conservation, or nonprofit purposes may qualify for valuation reductions or exemptions if use requirements are met.

Important: Eligibility rules are strictly defined and verified by the Auditor’s office.

Types of Property Tax Reductions and Exemptions

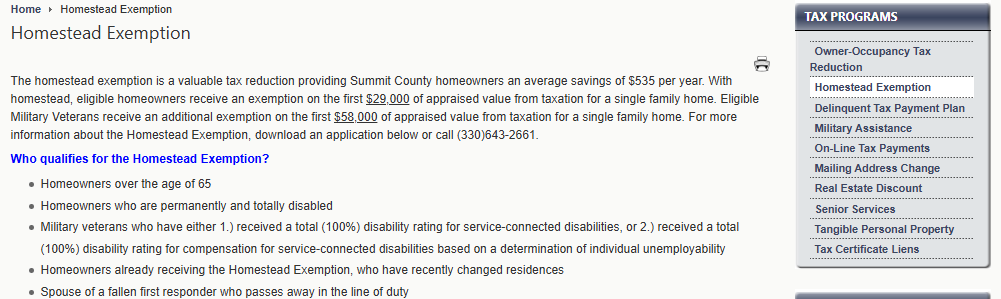

Homestead Exemption

Reduces taxes for eligible homeowners who occupy the property as their primary residence.

Disabled Veterans Exemption

Provides property tax relief to veterans with service-related disabilities or their surviving spouses.

Low-Income Senior Citizens Credit

Available for seniors with limited income to lower property tax liability.

Agricultural or Special Use Exemptions

Reduces taxes on land used for farming, conservation, or nonprofit purposes.

How to Apply for a Property Tax Reduction or Exemption

Step 1 – Determine Eligibility

Before applying, confirm you meet program requirements, which may include:

- Property occupancy or land-use evidence

- Proof of age or disability

- Veteran service documentation

- Income verification

Step 2 – Obtain Application Forms

Forms are available through:

- The Summit County Auditor’s Office

- The official county website

Step 3 – Complete the Application

- Fill out all sections accurately

- Attach required supporting documents

- Incomplete applications may be delayed or denied

Step 4 – Submit the Application

Applications may be submitted:

- In person at the Auditor’s Office

- By mail with copies of documentation

- Online, if electronic filing is available

Step 5 – Application Review and Approval

The Auditor reviews applications and verifies eligibility. If approved, the reduction or exemption is applied to the applicable tax year.

Tip: Approval does not guarantee permanent eligibility some programs require renewal.

Tips for a Successful Application

- Submit applications before the deadline (usually early in the tax year)

- Provide clear and complete documentation

- Verify eligibility requirements carefully

- Keep copies of all forms and supporting documents

- Contact the Summit County Auditor’s office for guidance if needed

Why Apply for Property Tax Reductions or Exemptions?

- Reduces overall tax burden for eligible residents

- Helps seniors and low-income individuals manage expenses

- Rewards veterans and supports service recognition

- Encourages proper land use and community development

- Ensures fair and equitable property taxation

Conclusion

Applying for a property tax reduction or exemption in Summit County, Ohio is an important way to lower your property tax liability legally. Understanding eligibility, gathering proper documentation, and submitting applications on time ensures you receive the benefits you qualify for. Whether you are a senior, veteran, disabled resident, or own qualifying property, these programs provide meaningful financial relief while promoting fair taxation.

FAQ’s

Who can apply for a property tax reduction in Summit County?

Eligible seniors, disabled residents, veterans, and owners of qualifying agricultural or special-use properties may apply.

Where do I get property tax exemption forms?

Forms are available from the Summit County Auditor’s Office or the county’s official website.

Can I apply for a property tax exemption online?

Online submission may be available, depending on the program. Otherwise, applications must be submitted in person or by mail.

What documents are required?

Required documents vary but may include proof of age, disability, veteran status, income, or property use.

When should I apply for a property tax exemption?

Applications should be submitted early in the tax year, before the deadline set by the Auditor.