Quick Answer:

Property tax rates in Summit County, Ohio are based on a property’s assessed value and local millage rates. Rates vary by municipality and school district, with residential properties typically assessed at 35% of market value and taxed per $1,000 of assessed value.

Understanding property tax rates in Summit County, Ohio is essential for homeowners, buyers, and real estate investors. Property taxes help fund schools, local governments, and public services across the county.

This guide explains how Summit County property tax rates work, how millage is applied, why rates vary by municipality and school district, and how you can estimate or manage your annual property tax bill.

What Are Property Tax Rates in Summit County?

A property tax rate is the percentage of a property’s assessed value that a property owner must pay annually. In Summit County, the assessed value is determined by the County Auditor, usually a percentage of the property’s market value.

Formula to calculate property taxes:Property Tax=Assessed Value×Tax Rate

The tax rate is typically expressed in mills, where 1 mill = $1 of tax per $1,000 of assessed value.

Who sets property tax rates in Summit County, Ohio?

Property tax rates in Summit County are set by local taxing authorities, including municipalities, school districts, and voter-approved levies, and are applied to assessed values determined by the County Auditor.

Factors That Affect Property Tax Rates in Summit County

Several factors influence the effective property tax rate:

- Municipality or School District – Different cities and school districts in Summit County have different rates.

- Property Type – Residential, commercial, agricultural, and industrial properties may have varying rates.

- Local Levies – Special levies for schools, fire districts, or public projects can increase the rate.

- Assessed Value – Higher assessed values lead to higher taxes, even at the same mill rate.

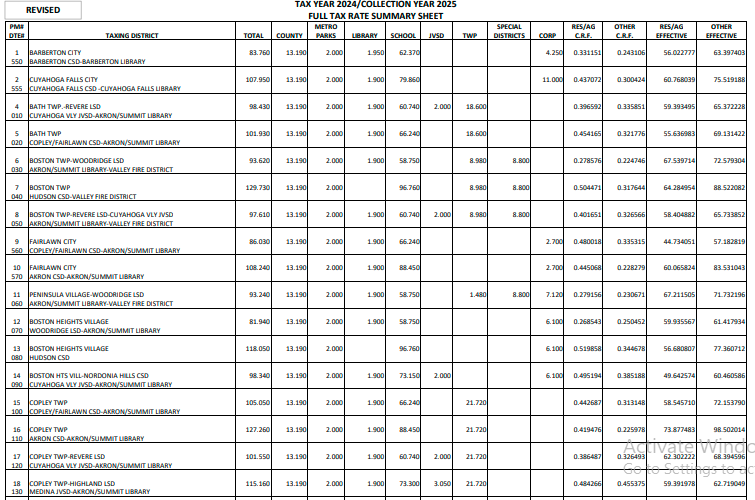

Summit County Property Tax Rates by Municipality (2026)

Property tax rates vary by city and school district within Summit County. Below are median effective rates for select municipalities. Below is an overview of the median effective property tax rates in select Summit County cities:

| Municipality | Residential Rate (per $1,000) | Commercial Rate (per $1,000) | School District Included |

|---|---|---|---|

| Akron | $55.50 | $61.75 | Akron Public Schools |

| Cuyahoga Falls | $49.20 | $54.10 | Cuyahoga Falls City SD |

| Barberton | $51.10 | $57.30 | Barberton City SD |

| Stow | $46.80 | $52.40 | Stow-Munroe Falls SD |

| Tallmadge | $47.50 | $53.00 | Tallmadge City SD |

| Hudson | $45.60 | $50.70 | Hudson City SD |

Note: Rates include county, municipal, and school district taxes. Special levies may apply in certain areas.

Understanding Millage Rates and Effective Tax Rates

- Millage: Property tax rate expressed in mills; 1 mill = $1 tax per $1,000 of assessed value.

- Effective Rate: Reflects the total tax burden including all local levies and school district taxes.

Example Calculation:

- Property Market Value: $200,000

- Assessed Value (35% of market value): $70,000

- Tax Rate: $50 per $1,000

Property Tax=1,00070,000×50=$3,500

Summit County School District Property Tax Rates

Schools are a major component of property taxes. Here’s a summary of some school district rates:

| School District | Residential Rate (per $1,000) | Commercial Rate (per $1,000) |

|---|---|---|

| Akron Public Schools | $25.30 | $27.50 |

| Cuyahoga Falls City SD | $23.40 | $25.10 |

| Barberton City SD | $24.50 | $26.00 |

| Stow-Munroe Falls SD | $22.80 | $24.20 |

| Tallmadge City SD | $23.00 | $24.50 |

| Hudson City SD | $21.90 | $23.70 |

School district levies can vary based on voter-approved initiatives, capital improvements, or operating levies.

How much are property taxes in Summit County, Ohio?

Property taxes vary by location and property type, but most homeowners pay taxes based on a millage rate applied to 35% of their property’s market value.

How Property Taxes Are Calculated in Summit County

Determine Assessed Value:

Most properties are assessed at a percentage of market value. Residential properties are often assessed at 35% of market value.

Apply the Mill Rate:

Multiply the assessed value by the total mill rate for your municipality and school district.

Add Special Levies:

Some areas may have fire, library, or park district levies.

Calculate Final Tax Bill:

Combine base property taxes with special levies for the annual bill.

Example Property Tax Bills in Summit County

| Property Type | Market Value | Assessed Value (35%) | Total Tax Rate | Annual Tax |

|---|---|---|---|---|

| Residential Home | $200,000 | $70,000 | $50 per $1,000 | $3,500 |

| Commercial Office | $500,000 | $175,000 | $55 per $1,000 | $9,625 |

| Vacant Land | $100,000 | $35,000 | $45 per $1,000 | $1,575 |

This table demonstrates how property type, assessed value, and tax rate combine to determine the annual property tax.

Paying Property Taxes in Summit County, Ohio

- Due Dates: Property taxes in Ohio are typically billed semi-annually, with first and second-half payments due in January and July.

- Payment Methods:

- Online through the Summit County Auditor or Treasurer website

- In-person at the county office

- By mail with check or money order

- Late Payments: May incur interest and penalties if not paid by the due date.

Important:

Missing a property tax payment deadline in Summit County may result in interest charges, penalties, or tax liens. Always verify due dates listed on your tax bill.

Tips to Reduce or Manage Property Taxes

- Check Your Assessment: Ensure your property information is accurate. Errors in lot size, square footage, or building details can increase taxes.

- Appeal Your Assessment: If you believe your assessed value is too high, you can file an appeal with the Summit County Board of Revision.

- Apply for Exemptions: Certain exemptions may reduce taxes, including homestead exemptions or senior citizen relief programs.

- Stay Informed on Levies: Voter-approved levies can increase taxes. Being aware helps you plan your budget.

Tip:

If your property’s assessed value seems higher than similar homes in your area, reviewing comparable sales can help support an assessment appeal.

Final Thoughts

Understanding property tax rates in Summit County, Ohio is essential for homeowners, buyers, and investors. Taxes are based on assessed value, mill rates, and local levies, with school districts often contributing a major portion of the bill. By reviewing assessments, checking current rates, and exploring exemptions or appeals, property owners can manage their tax burden effectively.

Tables and calculators make it easier to estimate property taxes, plan budgets, and stay informed about changes in tax rates for different municipalities and school districts.

Frequently Asked Questions (FAQs)

How are property tax rates determined in Summit County, Ohio?

Rates are based on assessed property value, local millage rates, school district levies, and other local government taxes.

What is the difference between mill rate and effective tax rate?

A mill rate is the tax per $1,000 of assessed value, while the effective tax rate includes all local levies, school taxes, and special assessments.

Can I appeal my property tax assessment?

Yes, if you believe your property is overvalued, you can appeal to the Summit County Board of Revision with supporting evidence.

Do different municipalities have different tax rates?

Yes, property tax rates vary by city, township, and school district within Summit County.

Are there ways to reduce my property taxes?

Yes, through exemptions, homestead credits, senior citizen relief programs, or by successfully appealing an over-assessment.